|

|

|

Dennis S. Lopez

Background

For Calendar Year 2000, the Local Government Units (LGUs) were supposed to get P121.788 Billion as their Internal Revenue Allotment (IRA). Due to the poor state of government finances, Congress substantially reduced the IRA. The President and the Department of Budget and Management (DBM) imposed measures to control the release of some portions of the IRA.

President Joseph E. Estrada signed into law Republic Act 8760 otherwise known as the CY 2000 General Appropriations Act (GAA) last February 16,2000. Under the 2000 GAA, the Internal Revenue Allotment (IRA) of the Local Governance Units (LGU) was allocated at P111.778 Billion, P10 Billion less from the P121.778 Billion. This P10 Billion cut was classified as "unprogrammed fund" under the 2000 GAA. This would mean that the P10 Billion would be given to the LGUs if the funds were available. Furthermore, there is also a provision in the GAA the amount of P5 Billion, earmarked as the Local Government Service Equalization Fund (LGSEF).

Prior to the enactment of the 2000 GAA, there were already attempts to reduce the IRA. The 2000 GAA bill that emanated from House of Representatives was passed without any reduction of the IRA. At the Senate however, the Finance Committee headed by Senator John Osmena proposed a P30 Billion IRA cut from "Programmed Fund" to "Unprogrammed Fund."

The LGUs through the Union of Local Authorities of the Philippines (ULAP) lobbied against the reduction. They even held two mass rallies and threatened to stage a four-day work stoppage. The NGO community through the Caucus of Development NGOs (CODE-NGO) and other NGOs supported the position of the LGUs and issued a one-page newspaper release in January.

On the eve of the start of LGU work stoppage, President Estrada called a meeting of the members of Congress, The ULAP and to avert the LGU strike. A compromise was reached with the Senate contingent agreeing to restore the P30 proposed IRA cut Subject to the issuance of two Executive Orders.

In early January 2000, Finance Secretary Jose Pardo presented to Congress a more conservative estimate of revenue targets. The figures cited by Secretary Pardo prompted Congress to place P10.Billion of the IRA as an "unprogrammed fund."

On December 21,1999, Executive Order No. 189 was issued by the President "DIRECTING ALL LOCAL GOVERNMENT UNITS TO SUBMIT TO THE DESPARMENT OF BUGET AND MANAGEMENT THEIR RESPECTIVE ANNUAL INVESTMENT PLAN." Subsequently, Executive Order No. 190 was also issued on the same day entitled "DIRECTING THE DEPARTMENT OF BUDGET AND MANAGEMENT TO REMIT DIRECTLY THE CONTRIBUTIONS AND OTHER REMITTANCES OF LOCAL GOVERNMENT UNITS TO CONCERNED NATIONAL GOVERNMENT AGENCIES (NGA), GOVERNMENT FINANCIAL INSTITUTIONS (GFI) AND GOVERNMENT OWNED AND/OR CONTROLLED CORPORATIONS (GOCC)."

The National Government Impositions on the IRA

The P10 Billion "Unprogrammed Fund"

The P10 Billion "unprogrammed fund" will only be released to the LGUs based on the availability of the funds. Thus, during the 15th National Executive Board meeting of ULAP held last February 23, 2000, DBM Secretary Benjamin Diokno pledged that the P10 Billion "unprogrammed fund" will be funded by April 2000.

Last April 26, 2000 President Estrada met with the Governors and Officers of ULAP in Malacanang. The President instructed the DBM Secretary to release the P2.5 Billion or 25% of the P10 Billion. According to the May 20, 2000 article of the ULAP Newsletter, the 25% release represents only the first quarter. However, some local officials present during the meeting did not hear anybody saying that this is going to be a quarterly release. If this will be a quarterly release there should have been news or indication already that next trance will be available this month of June.

The Notice of Cash Allotment (NCA) and the Sub-Allotment Release Order Regional Operations for the P2.5 Billion as mid-year bonus for national government employees. Early this year, P4 Billion was release to national government agencies for the payment of salary adjustments.

Executive Order 189

"DIRECTING ALL LOCAL GOVERNMENT UNITS TO SUBMIT TO THE DEPARTMENT OF BUDGET AND MANAGEMENT THEIR RESPECTIVE ANNUAL INVESTMENT PLAN."

The issuance of the two Executive Orders (189 & 190) is a result of a compromise agreement between Congress, ULAP and the Executive Department. At first glance these documents look harmless to E.O. 189 was issued last March 14, 2000 by the DBM, it was evident that the release and utilization of the LGUs 20% development Fund will be the dictate of the national government.

DBM Circular 70 on Item 2, general Policies, outlines the eleven(11) priority considaration areas for the utilization of the 20% Development Fund:

a) Solid waste management which may include purchase of related equipment, trucks and compactors, as well as purchase of land for sanitary land fill purposes;

b) Purchase of lots for hospitals, health centers, day care centers and similar facilities including the construction, repair and maintenance of such facilities;

c) Purchase of lots for resettlement of squatters, including construction of housing units and facilities.

d) Activities in support of the Food Security Program, Livestock Dispersal, Fisheries Development and Fish Culture Farming Program;

e) Initiative in support of cooperative development;

f) Construction, maintenance and/or repair of post harvest facilities, irrigation and other agricultural production systems;

g) Construction, maintenance and/or repair of local roads and bridges;

h) Construction, maintenance and /or repair of water and sewerage systems, as well as, power and communication facilities;

i) Construction, maintenance and/or repair of public buildings which may include purchase if equipment necessary in the implementation of infrastructure undertaking;

j) Other infrastructure or capital outlay projects supportive of the annual component of the development plan of LGU concerned, e.g, flood control projects;

k) Payment of loans covering goods and services in connection with projects herein listed, subject to budgeting and accounting rules and regulations.

The said Circular, in effect directs

the Local Development Councils to redo their Annual

Investment Plans to be funded out of the Development Fund. Note that the Circular

was issued last March 14, 2000 or near the close of the first quarter of 2000.

Furthermore, under item 3.3 on the Release of Cash Requirement for the 20% Development Fund provides that the cash requirement corresponding to the 20% development fund shall be released by the DBM Regional Offices concerned on the basis of the quarterly cost requirement. Moreover, the quarterly IRA allocation inclusive of the Development Fund shall not exceed 25% of the annual IRA share of the LGU and when necessary, the progress billing scheme may be adopted in the release of cash requirements.

With this imposition, ULAP raised four (4) valid issues to which DBM responded accordingly last May 19, 2000:

1) Duplication in requiring LGUs to submit a separate AIP other than that submitted / including in the annual budget. This would mean that the LGUs would have to reprogram everything, particularly their expenditure pattern. The DBM said that their Regional Offices (RO) have already been instructed to consider the AIPs submitted and included in their annual budgets. Inasmuch as only provinces and highly urbanized cities are submitted for review to our Regional Offices, the budget officers of provinces, component cities and municipalities have been requested to assist our Regional Offices in culling out from the annual budget of LGUs under the individual provinces, the AIPs which pertain to the 20% development fund, for submission to DBM Regional Offices;

2) Return by DBM ROs of AIPs sumitted by LGUs due to non-conformity with provision of implementing guidelines and form. According to DBM, they have already instructed their ROs not to return the AIPs submitted by the LGUs to release the 20% development fund with notation should there be projects which are outside of the priority areas or not consistent with E.O. 189;

3) Why require AIP Form No. 1? DBM admitted that Form No. 1 is intended for cash programming purposes and to facilitate consolidation.

4) Period of Review of AIPs by DBM Ros. DBM relayed to ULAP that under LBC 70,one month from the receipt of the AIP,DBM is to review and respond to the LGUs, otherwise the AIP is deemed as compliance by LGUs with the provisions of E.O. 189.

According to the League of Provinces,

the provinces have complied with E.O. 189 and

LBC 70 and are now being released portions of their 20% development fund for

the first quarter.

This national imposition clearly dips into the manner how LGUs should spend for their development plans. The added burden of culling out fr7om their budget the projects funded out of the 20% development is not only an administrative nightmare, it also in a sense telling the LGUs not to proceed if DBM does not say so.

Executive Order 190

"DIRECTING THE DEPARTMENT OF BUDGET AND MANAGEMENT TO REMIT DIRECTLY THE CONTRIBUTIONS AND OTHER REMITTANCES OF LOCAL GOVERNMENT UNITS TO CONCERNED NATIONAL GOVERNMENT AGENCIES (NGA), GOVERNMENT FINANCIAL INSTITUTIONS (GFI) AND GOVERNMENT OWNED AND/OR CONTROLLED CORPORATIONS (GOCC)."

The contributions and remittances to national agencies concerned here are the GSIS, PAG-IBIG Fund, Employees Compensation Insurance Premium, Health Insurance Fund and the BIR authorized withholding tax.

There are brewing problems in the implementation of this order. It seems that in the case of GSIS remittances, the LGUs books and GSIS records do not reconcile with each other. LGUs claim that the have already paid while the GSIS says otherwise. The problem is that based on the Executive Order, the DBM shall remit directly to the concerned agencies the LGU contributions, which shall likewise be deducted, from the IRA.

There is no figure available as to the aggregate amount of the contributions and remittances of the LGUs. The DBM's deduction will definitely be based on the records of the concerned national agencies.

The Local Government Service Equalization Fund (LGSEF)

In the 2000 GA under the Special Provisions

of the IRA it states that "PROVIDED, That the amount of Five Billion Pesos

(P5,000,000,000) shall be earmarked for the Local Government Equalization Fund

for the funding requirements of projects and activities arising from full an

efficient implementation of devolved functions and services of local government

units pursuant to R.A.7160 otherwise known as the Local Government Code of 1991:

PROVIDED, FURTHER, That such amount shall be released to the local government

units in accordance with the implementing rules and regulations, including such

mechanisms and guidelines for the equitable allocations and distributions of

said fund among local government units subject to the guidelines prescribed

by the Oversight Committee on Devolution as constituted pursuant to Book IV,Sec.533(b)

of R.A.7160."

This Special Provision likewise appeared in the 1999 GAA. For the 1999 LGSEF only P12 Million is not release to the LGUs. In 1999, the Oversight Committee on Devolution (OCD) came up with the implementing guidelines including the mechanisms for the equitable allocation of the said fund, approved the following scheme (OCD Resolution No.99-005):

* 40% Allocated in accordance with the formula prescribed for under the Local

Government Code of 1991 (OCD Resolution 99-006)* 40% Allocated in accordance with a modified 1992 Cost of Devolved

Function (CODEF) sharing scheme, as follows (OCD Resolution

99-006):Provinces 40%

Cities 20%

Municipalities 40%

* 20% Shall be earmarked to support Local Affirmative Projects and other priority initiatives submitted by LGUs to the OCD in accordance with its

prescribed guidelines (OCD Resolution No.99-003).

This first tranche (40% or P2 Billion) which was allocated based on Codal Formula

was released in July 1999. The second tranche of P2 billion, which was allocated,

based on the modified CODEF formula was released last February 11, 2000.

The 20% or P1 Billion which was set

aside for the Local Affirmative Action Projects and

other priority initiatives broken down to: 1) P100 Million as financial assistance

to all provinces, cities and municipalities for their participation in the "Palaro

ng Bayan." 2) A total of P837.5 Million has already been approved and released;

3) the remaining P62.5 Million was recommended by the OCD with the following

allocation:

Provinces P34 Million

Municipalities P15 Million

Cities P6.750 Million

Barangays P6.750 Million

There is an agreement in principle by the members of the OCD that the same allocation scheme in 1999 LGSEF be adopted for the 2000 LGSEF.

The Diminishing Discretion of LGUs over their own Resources

Slowly the LGUs are loosing their grip on how and when to use their own funds, particularly their IRA shares. From 1992 to 1997, the LGUs have a freehand on how to use their IRA shares. However, in December 27, 1997, then President Fidel V. Ramos issued an Administrative Order No.372 "Adopting Economy Measure in Government for Fiscal Year 1998" which under Section 4 calls for the withholding 10% of the IRA. In 1998, during the early days of Estrada presidency, the Leagues requested the President to restore the 10% IRA, however only 5% was returned to the LGUs.

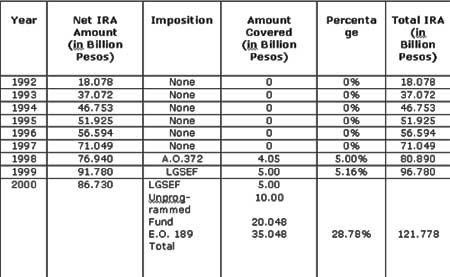

In 1998, the total IRA is P80.89 Billion, of this P4.05 Billion or 5% was with held by the national government as a belt tightening measure. In 1999, with the P5 Billion LGSEF, 5.16% of the total IRA of P96.78 Billion, is under the control of the OCD.

This year, the LGUs' hold on their IRA diminished tremendously by 28.78% or P30.048 Billion from the total IRA of P121.778 Billion - P10 Billion as " unprogrammed fund," P5 Billion as the LGSEF and with E.O. 189 on the use and release of the 20% Development Fund, another P20.048 Billion.

Table 1 illustrates the Comparative IRA from 1997 to2000 being subjected to National Government impositions.

Table 1

Comparative

IRA 1992-2000 Being Subjected

to National Government Impositions

Effects of the IRA Impositions

Obviously if the LGUs budgets were made under the assumption that they will be getting the full share of the IRA, but the reality is that almost 30% of their IRA is not anymore under their discretion, the result will surely be a distorted LGU operation. The IRA was intended to give the LGUs a more certain source of funds to deliver basic services and implement development plans. The certainty of their just share from national taxes is assured by law and guided by a simple formula of distribution. It seems now that the LGUs will have to stall many development plans because they are not in full control of their own resources. If there is no full control and uncertainty, it will be difficult for the LGUs to commit with the development partners. Worst, is that they might face legal sanctions if they forgo their commitment because of fund uncertainty.

Another issue that might be experienced by the LGUs and may trigger personnel discontent is the Salary cap provision of the Code. Sec. 325 of the Code under General Limitations, provides that "… a) The total appropriations, whether annual or supplemental, for personal services of a local government unit for one (1) fiscal year shall not exceed forty-five percent (45%) in the case of first to third class proc\vices, cities and municipalities, and fifty-five percent (55%) in the case of fourth class or lower, of the total annual income from regular sources realized in the next preceding fiscal year." The regular income here refers to the locally generated revenues and the IRA. With the uncertainty of the IRA, which represents the bulk of the LGU, income there might have a situation where LGUs cannot pay in full the salaries and benefits of their employees.

The unseen effect of the IRA issue is the destabilization of LGU operations. Any fund reduction whether from local sources or from the IRA will affect how the LGUs deliver basic services and their ability to respond to the complex demands of local governance. The IRA issue, therefore is a self-inflicted destabilization move by the national government itself. The perceived destabilization efforts blamed on anti-administration forces and terrorist group pale in comparison to what may happen if the national government will restrain and withhold funds for delivering basic services and implementation of local development plans.

Hopes and Expectations

The fervent hope of all the stakeholders is for the certainty of the just share of LGUs in the national taxes known as the IRA in the next year to come. Examining the assurances and promises of the national government, there is less to expect with regard to a favorable resolution of the IRA issue.

During the 2000 Budget deliberation the LGUs were made to believe that Congress will restore the P30 Billion IRA "unprogrammed fund," if E.O. 189 and E.O. 190 were issued. In the approved budget only P20 Billion was restored, leaving the P10 Billion as "unprogrammed fund."

The P10 Billion "unprogrammed fund" will be released by April 2000 as promised by DBM Secretary Diokno. The President instructed Sec. Diokno to release P2.5 Billion or 25% of the P10 Billion. It is not clear if the succeeding releases will be on a quarterly basis.

The release of the 20% Development Fund will be released to the LGUs if they comply with E.O. 189 but when DBM issued LBC 70, the LGUs were required to accomplish Form 1 to show the breakdown the AIPs quarter cash requirements, further delaying the releases.

On the creation of new cities and provinces, the President assured the local officials that he would extend the moratorium on the new LGUs. The President released P5 million for the plebiscite to divide the province of Mindoro Oriental.

Last of the known promises, the President assured the local officials that beginning Calendar Year 2001, the IRA would be automatically appropriated similar to the debt service. Congress has yet to agree on the President's proposal.

On the possible abolition of the LGSEF, the Leagues have lost the ascendancy to advocate for its abolition. As part of the OCD, the Leagues of Provinces, Cities, Municipalities and the Liga ng mga Barangay are parties to the OCD Resolution No. 99-002 "RESOLUTION REQUESTING HIS EXCELLENCY PRESIDENT JOSEPH EJERCITO ESTRADA TO APPROVE THE INCLUSION OF THE LOCAL GOVERNMENT SERVICE EQUALIZATION FUND (LGSEF) IN THE CY 2000 GENERAL APPROPRIATIONS BILL IN THE AMOUNT OF AT LEAST PHP 5 BILLION AND TO DIRECT THE DBM TO ENSURE INCLUSION." This Resolution was approved last June 16, 1999. Although in the said resolution there is a clause, which states that "RESOLVED FURTHER, that for CY 2000 and succeeding years, said budget appropriations for the LGSEF shall be sourced out side the IRA shares of the LGUs," similar to the 1999 experience, the 2000 LGSEF was carved out again from the IRA. The original intention of the LGSEF is to provide funds for those LGUs having financial difficulties in delivering devolved services. With the LGSEF taken from the IRA, the LGUs are made to haggle among themselves for their rightful share, when the LGUs know very well that is theirs in the first place.